A Guide to Travel Insurance Options for Every Adventure

You’ve spent months, maybe even years, dreaming up the perfect getaway. It could be a ski adventure chasing powder in the Alps, a big family reunion in a Tuscan villa, or that once-in-a-lifetime safari you’ve always talked about. But what happens when life, in its infinite wisdom, throws a massive curveball? The best travel insurance options are your safety net, your secret weapon, the one thing that protects your hard-earned vacation fund from the unexpected.

Protecting Your Wanderlust from the Unexpected

Let’s paint a picture. The tickets are booked for your family’s spring break trip to Costa Rica. You’ve reserved a stunning eco-lodge with zip-lining tours and surf lessons all lined up. The kids are literally counting down the days. Then, a week before you leave, your youngest gets a nasty flu, and the doctor says absolutely no travel. Without insurance, you could be out thousands in non-refundable deposits. Poof! Gone.

Or how about this one: you and your friends have meticulously planned a ski trip to Jackson Hole. Flights are booked, the condo is paid for, and your new skis are practically begging for snow. But a monster blizzard grounds all flights into the region for two solid days, forcing you to miss the best part of your trip. Travel insurance was made for moments exactly like these. It’s the ultimate ‘Plan B’ for your ‘Plan A’.

More Than Just a Policy

Try to think of travel insurance not as a boring, check-the-box chore, but as your adventure’s most reliable sidekick. It’s the invisible piece of gear that lets you embrace the journey with total peace of mind. Here at Those Who Wander, we’re firm believers that smart, proactive planning is the secret to a genuinely carefree trip. It’s about making things happen, even when the universe tries to get in the way.

A great trip is built on confidence. Knowing you’re protected allows you to fully immerse yourself in the experience, whether that’s navigating the bustling markets of Marrakech or skiing fresh powder in the backcountry.

This guide will walk you through the essential travel insurance options, breaking down how this one simple step protects your financial investment and makes sure you’re ready for anything. We’ll explore the different types of coverage, from trip cancellation to emergency medical, so you can choose the perfect shield for your next great story.

Decoding the Different Types of Travel Coverage

Choosing the right travel insurance can feel a bit like ordering from a menu in a new country—a little confusing, but you know there’s something great in there for you. Let’s break down the main ‘dishes’ so you can confidently build the perfect plate of protection for your next big adventure.

First up is the star player on the team, the one everyone thinks of first: Trip Cancellation & Interruption. Think of it as your financial bodyguard for all those non-refundable deposits you’ve paid.

Imagine you’ve just put down the final payment on that gorgeous Tuscan villa for a big family reunion. A week before you fly out, your father-in-law has a health scare, and his doctor advises against international travel. Trip Cancellation is what swoops in to reimburse you for those prepaid costs.

Trip Interruption is its trusty sidekick. It helps if you have to cut your trip short for a covered reason, getting you home and covering the unused portion of your vacation.

The Heavy Hitters: Medical and Evacuation

While protecting your trip investment is key, nothing is more important than your health. That’s where Emergency Medical & Evacuation coverage comes in, acting as a superhero for unexpected health issues abroad. Many domestic health plans offer very limited—or even zero—coverage outside your home country.

Let’s say you’re on a ski trip in the Swiss Alps and take a nasty fall, resulting in a broken leg. Your standard health insurance back home might not touch the foreign hospital bill, which could be staggering. A good travel policy handles these emergency expenses.

Medical Evacuation is its powerful partner. It covers the cost to transport you to an adequate medical facility—or even all the way home—if the local hospital can’t provide the care you need. For remote adventures, this is non-negotiable.

These core coverages—Trip Cancellation/Interruption and Emergency Medical/Evacuation—form the foundation of most comprehensive travel insurance plans. They address the two biggest ‘what ifs’ of travel: losing your money and facing a health crisis far from home.

This growing awareness of risk is one reason why travel insurance has boomed. Globally, the travel insurance market was valued at about $23.8–$27.0 billion, with forecasts projecting massive growth over the next decade. What was once a niche add-on is now a mainstream planning tool for savvy travelers. You can discover more insights about the travel insurance market on Grand View Research.

To make it a little easier to see how these fit together, here’s a quick cheat sheet.

Travel Insurance Coverage at a Glance

| Coverage Type | What It Covers | Best For |

|---|---|---|

| Trip Cancellation/Interruption | Reimburses non-refundable costs if you have to cancel or cut your trip short for a covered reason. | Any trip with significant prepaid, non-refundable expenses (flights, tours, hotels). |

| Emergency Medical | Covers unexpected medical bills for accidents or illnesses that happen while traveling. | All international travel, cruises, and remote domestic trips. |

| Medical Evacuation | Covers the cost of transporting you to an adequate medical facility or back home if necessary. | Adventure travel, cruises, and trips to remote or developing areas. |

| Baggage Loss & Delay | Reimburses you for essentials if your bags are delayed, or for your belongings if they’re lost or stolen. | Any trip involving checked luggage, especially with multiple connections. |

| Cancel For Any Reason (CFAR) | An optional upgrade that allows you to cancel for reasons not covered by a standard policy. | Travelers who want maximum flexibility and peace of mind for complex or expensive trips. |

This table gives you the basics, but let’s dive a little deeper into the other common types of coverage you’ll see.

When Your Luggage Takes Its Own Detour

Next up is coverage that deals with one of travel’s most classic frustrations: Baggage Loss & Delay. We’ve all felt that sinking feeling at the baggage carousel as the last bag comes out and it isn’t yours. This coverage is your saving grace when your luggage decides to embark on its own separate vacation.

If your bags are delayed for a certain number of hours, the policy can reimburse you for essential items you need to buy, like a change of clothes and toiletries. If your bag is lost or stolen for good, it provides reimbursement up to the policy limit, helping you replace your belongings.

The Ultimate Flexibility Upgrade

For those who want the highest level of freedom, there’s a powerful add-on called Cancel For Any Reason (CFAR). Standard policies only cover cancellations for specific, listed reasons. CFAR is exactly what it sounds like—it lets you cancel for literally any reason that isn’t already covered.

Maybe your pet-sitter bailed at the last minute, a big project at work blew up, or you simply don’t feel like going anymore. With CFAR, you can typically get 50-75% of your non-refundable trip costs back.

There are a couple of catches: you usually have to buy it shortly after your initial trip deposit (often within 14-21 days), and it costs more. But for that extra investment, you get ultimate peace of mind. For families juggling complex schedules, this flexibility is often a perfect fit, which is why we break down our top picks in our guide to the best travel insurance for families.

Matching Your Insurance to Your Itinerary

Every adventure has its own rhythm, its own personality. A jam-packed family trip to Disney World feels completely different from a serene honeymoon in Santorini, and your travel insurance should reflect that. Think of it like packing clothes—you wouldn’t bring ski gear to the Caribbean. The best travel insurance options are the ones that fit your specific itinerary like a glove.

At Those Who Wander, we don’t just find you a policy; we match the protection to the plan. It’s all about looking at your unique trip and asking, “What’s the one thing that could really throw a wrench in these amazing plans?” From there, we build your safety net. This is where the fun of planning meets the pragmatism of being prepared.

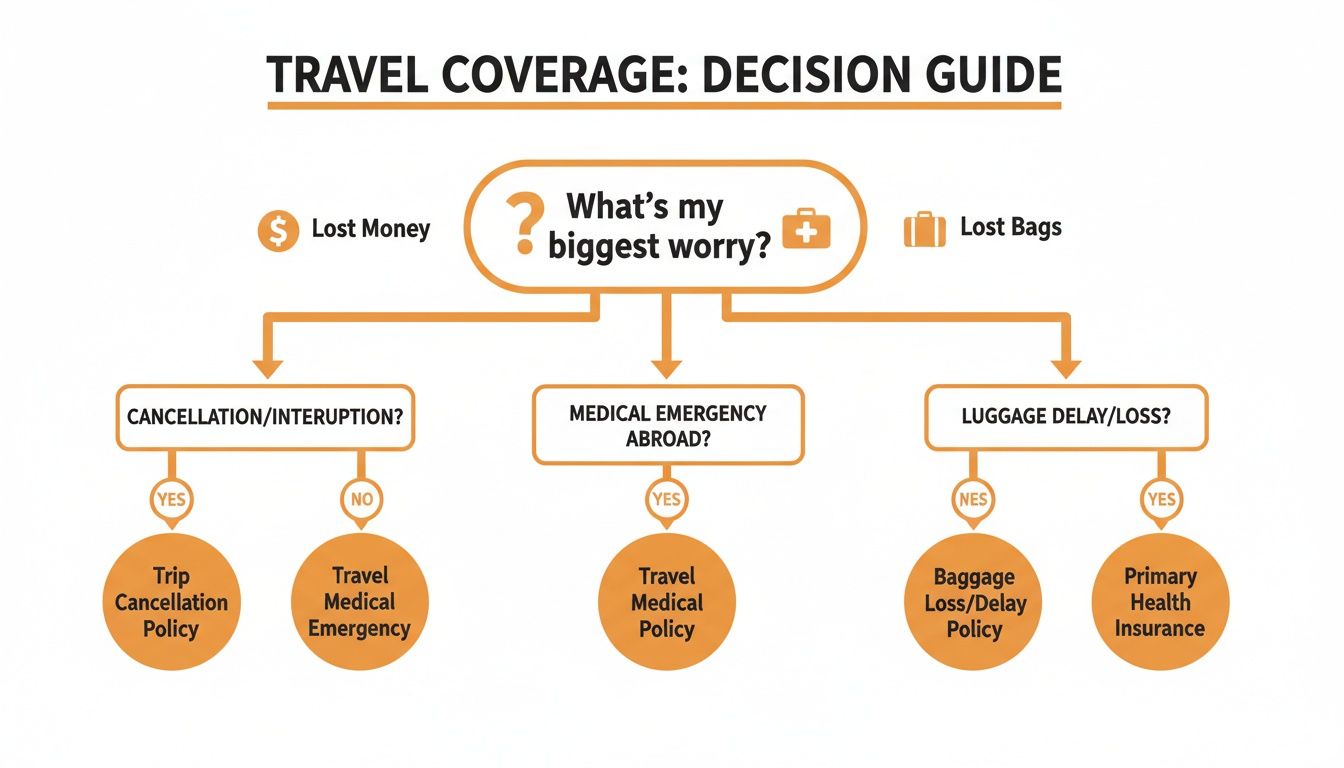

To help you get started, we’ve put together a simple decision guide. This visual tool helps you pinpoint your main travel concern and see which type of coverage makes the most sense.

As you can see, once you identify your biggest worry—whether it’s losing your financial investment, facing a medical crisis, or dealing with lost bags—you can quickly zero in on the most critical coverage for your trip.

For the Adventurers and Thrill-Seekers

Are you gearing up for a rugged ski trip in Jackson Hole or a multi-day trek in Patagonia? For you, a standard, off-the-shelf policy probably isn’t going to cut it. Your kind of adventure comes with unique risks, and your insurance needs to rise to the occasion.

We’re talking about more than just lost luggage. Your biggest concerns are likely medical emergencies in a remote location and protecting thousands of dollars in specialized gear.

For an adventure traveler, Medical Evacuation coverage isn’t a luxury; it’s an absolute essential. If you get injured on a remote trail or a black diamond ski run, the cost to get you to a proper hospital can be astronomical. A high-limit evacuation policy is your lifeline.

Here’s what a perfect policy looks like for you:

- High-Limit Medical Evacuation: Don’t even think about a plan with less than $250,000 in evacuation coverage, especially if you’re headed somewhere off the beaten path.

- Adventure Sports Coverage: Many basic plans have fine print that excludes “hazardous” activities. You need a policy that explicitly covers skiing, snowboarding, or trekking. Our guide on how to plan a ski trip gets into why this specialized coverage is so important.

- Sports Gear Protection: Your skis, climbing gear, or camera equipment are worth a lot. Make sure your policy has adequate limits for them, because standard baggage coverage is often laughably low.

For the Family on the Go

Planning a family trip to a theme park or a multi-generational cruise? Your priorities shift completely. The logistics get more complex, the upfront investment is way bigger, and you’re trying to coordinate a dozen different schedules.

For you, the biggest risk is almost always a last-minute cancellation. If one of the kids gets a nasty ear infection or a grandparent can’t make it, you need to protect the thousands you’ve already spent on non-refundable park passes, flights, and condos.

A solid family-focused plan should include:

- Strong Trip Cancellation & Interruption: This is your #1 priority. It protects that huge financial investment you’ve made.

- Comprehensive Medical for All Ages: Check to make sure the policy covers everyone, from the youngest toddler to the oldest grandparent, with solid emergency medical benefits.

- Baggage Delay Coverage: With kids in tow, a delayed bag full of their essentials can quickly turn a fun vacation into a frantic, expensive shopping spree. This coverage reimburses you for the necessities while you wait.

For the Romantic Getaway

That once-in-a-lifetime honeymoon or anniversary trip is a huge investment, both financially and emotionally. You’ve likely booked special tours, romantic dinners, and that perfect boutique hotel room with a view.

The goal here is to protect the entire experience. Your insurance should be a comprehensive shield that covers everything from a sudden cancellation to a medical issue that could completely derail your romantic plans.

Your ideal plan has:

- High Trip Cancellation Limits: Enough to cover all your non-refundable bookings, from that overwater bungalow to the private cooking class you were so excited about.

- ‘Cancel For Any Reason’ (CFAR) Add-On: For the ultimate peace of mind. This upgrade lets you cancel for reasons a standard policy won’t cover, getting you back up to 75% of your trip cost.

- 24/7 Travel Assistance: This is invaluable. Having a service that can help you rebook flights or find a reputable doctor abroad means you can focus on each other instead of logistics.

For the Coordinated Crew

Organizing a corporate retreat, a destination wedding party, or a sports team trip? You’ve got a whole different set of challenges. Trying to manage individual plans for a large group is a logistical nightmare.

This is where group travel insurance really shines. Instead of a dozen separate policies, a group plan covers everyone under a single, simplified umbrella. It makes administration a breeze and ensures everyone has the same level of protection.

Key features of a great group policy:

- Simplified Enrollment: One policy for the entire group saves a ton of time and cuts down on administrative headaches.

- Consistent Coverage: Everyone gets the same level of protection, so there are no gaps or confusion about who has what.

- Often More Cost-Effective: Group plans can sometimes offer better rates than buying a pile of individual policies for a large number of travelers.

No matter what your itinerary looks like, the right insurance is out there. It’s just a matter of taking a moment to match your travel style to the right protection, ensuring your focus stays where it should be—on the incredible journey ahead.

Making Sense of the Not-So-Fun Fine Print

Let’s be real—nobody gets excited to read the fine print. It’s dense, confusing, and feels like it was designed to make your eyes glaze over. But with travel insurance, this is exactly where the magic happens. Understanding these details is what separates true peace of mind from a nasty surprise right when you need to file a claim.

So, let’s pull back the curtain on the boring stuff and make it simple. We’ll skip the jargon and get straight to what matters: coverage limits, common exclusions, and those infamous pre-existing conditions. We’re here to make sure you’re never caught off guard.

Decoding Pre-Existing Conditions

That term, “pre-existing condition,” causes more headaches than just about anything else in travel insurance. In simple terms, it’s any illness or injury you’ve received treatment, diagnosis, or new medication for in the 60 to 180 days before buying your policy.

This could be anything from a chronic issue like asthma to a recent back injury you saw a physical therapist for. If that condition flares up and forces you to cancel your ski trip to Vail, a standard policy might leave you high and dry.

But there’s a fantastic workaround: the Pre-Existing Medical Condition Exclusion Waiver. This is a powerful addition that essentially erases that exclusion, giving you coverage if your condition unexpectedly worsens. The catch? You have to buy your policy within a specific time frame—usually 14 to 21 days after making your very first trip payment.

This waiver is a total game-changer. It means you can book that ambitious trek through Peru or a big family reunion cruise with confidence, knowing you’re protected even if a stable, managed health condition unexpectedly throws a wrench in your plans.

Buying your policy early is the key that unlocks this critical protection. It’s one of the single biggest reasons to get your insurance sorted out right after you book.

What Your Policy Might Not Cover

Every insurance policy has exclusions—specific situations or items it simply won’t cover. Think of them as the ground rules of the game. Knowing these upfront saves a lot of frustration later.

Some of the most common exclusions you’ll find in travel insurance options include:

- High-Risk Adventure Sports: Your standard policy is perfect for a European city tour, but it probably won’t cover heli-skiing in Alaska or scuba diving in a cenote. For those kinds of thrills, you’ll need to add a special adventure sports rider.

- Foreseeable Events: Insurance is built to cover the unexpected. If a major hurricane is already named and churning toward your Caribbean destination before you buy a policy, any claims related to that storm will almost certainly be denied. The event was already a known risk.

- Mental Health Conditions: While coverage is getting better, many basic policies still exclude cancellations due to things like anxiety or depression. Always check the specific wording in your policy documents if this is a concern for you.

Why Coverage Limits Matter More Than You Think

Finally, let’s talk about coverage limits. This is the maximum amount of money the insurance company will pay out for a specific type of claim. It’s easy to see a big number and think you’re set, but the details really do count here.

Imagine you’re planning a remote safari in Tanzania. A basic policy might offer $50,000 in emergency medical coverage. That sounds like a lot, right? But a serious medical situation in a remote location could blow past that figure once you add up local hospital care and transportation costs.

This is why we always stress matching your limits to your destination and activities.

- For remote or adventure travel: We recommend a bare minimum of $100,000 in emergency medical coverage and $250,000 or more for medical evacuation.

- For a domestic trip: Lower limits might be perfectly fine, especially if you have good health insurance that works across state lines.

The same logic applies to your bags. If you’re traveling with expensive camera gear or a couple of high-end bikes, a standard $500 baggage limit won’t come close to covering your loss if something goes wrong. Getting these limits right ensures you’re never underinsured, so you can focus on the adventure ahead.

How We Weave Protection into Your Travel Plans

Here at Those Who Wander, we don’t think of travel insurance as some boring add-on you tack on at the very end. For us, it’s a critical thread woven right into the fabric of your trip from the moment we start planning. We won’t just hand you a generic policy brochure and wish you luck; we act as your personal insurance curator, making sure your protection is as unique as your trip.

It all starts with a conversation, not a checklist. Are you planning a big multi-generational family reunion at a sprawling Italian villa, complete with hefty, non-refundable deposits? Or maybe it’s a rugged ski trip to Whistler where a sudden blizzard could ground your flight and keep you from that fresh powder.

Every detail you share tells us a story about what could go sideways. We listen, and then we get to work.

Your Personal Policy Matchmaker

Think of us as matchmakers for your policy. We take your traveler profile and your specific itinerary, then dive into the world of travel insurance options from our trusted partners to find the perfect fit. We do all the heavy lifting—poring over the fine print, comparing coverage limits, and finding the best value—so you don’t have to.

This hands-on approach is one of the key benefits of using a travel agent; we translate the confusing jargon into simple, clear choices.

For that big family trip to Italy, we’d zero in on a plan with two essential features:.

- Robust Trip Cancellation: Something strong enough to protect the significant investment you’ve sunk into that beautiful villa and those pricey international flights.

- Solid Medical Coverage: A policy that works for everyone, from the grandkids to the grandparents, making sure everyone has top-notch protection if needed.

We don’t believe in one-size-fits-all. Your adventure is custom-built, and your safety net should be too. Our goal is to present you with a few great choices that make sense for your journey, not someone else’s.

Making an Informed Decision

When travelers debate if insurance is really worth it, the stats don’t lie. Industry data consistently shows that trip cancellation and interruption are the most common claim types, safeguarding your financial investment from unexpected hurdles. Right behind them are emergency medical expenses, which are especially critical when you’re traveling internationally or heading out on an adventure. You can read the full research on travel insurance trends to see why this protection is so vital.

We bake these realities right into our planning. For an adventure traveler heading to Patagonia, we’d make high-limit medical evacuation a top priority. For a couple on their honeymoon, we might suggest adding a ‘Cancel For Any Reason’ upgrade for ultimate flexibility.

At the end of the day, our job is to make things happen—and that includes being ready for the moments when things don’t go according to plan. By weaving the right protection into your trip from the start, we make sure your peace of mind is locked in, freeing you up to focus on what really matters: the incredible journey ahead.

Your Top Travel Insurance Questions Answered

Feeling a little curious? Good. When it comes to something as important as protecting your trip, asking questions is the first sign you’re planning like a pro. We hear a lot of the same ones from fellow wanderers, so we’ve gathered them right here to give you clear, straight-up answers.

Think of this as our little campfire chat, a chance to tackle the big “what ifs” so you can head out on your next adventure feeling ready for anything.

When Is the Best Time to Buy Travel Insurance?

I’ll make this simple: the absolute best time to buy your policy is right after you make your first non-refundable trip payment. This isn’t a sales pitch; it’s a strategy. That first payment could be for your flights, a tour deposit, or that charming French gîte you just booked.

Why the rush? Because buying early unlocks the most powerful benefits. Many policies have time-sensitive perks, like a waiver for pre-existing medical conditions or the coveted ‘Cancel For Any Reason’ (CFAR) upgrade. These are only available if you purchase your plan within 14 to 21 days of that initial deposit.

Waiting until the week before you leave is like trying to buy a fire extinguisher after you see smoke. Sure, you can still get some coverage, but your best and most comprehensive options will have already vanished. Act fast, and you’ll have the widest possible safety net protecting your investment from day one.

Does My Credit Card Offer Enough Protection?

This is a fantastic question and one we get all the time. It’s easy to look at the travel perks on your premium credit card and assume you’re all set. While those benefits can be handy for small hiccups, relying on them for a major trip is a real gamble.

Think of your credit card coverage as a helpful travel buddy, not your main security detail. It’s usually pretty good for smaller, specific issues.

Here’s what cards typically offer:

- Basic Baggage Delay: They might cover a new toothbrush and a change of clothes if your bag takes an extra 12 hours to find you.

- Rental Car Waivers: Many cards provide collision damage waivers, which is a genuinely great perk.

- Limited Trip Interruption: They may cover a small fraction of your loss if your trip is cut short for a very specific reason listed in the fine print.

The problem is, credit cards have massive gaps. Their medical expense limits are often dramatically lower (or non-existent for international travel), and most critically, they almost never include emergency medical evacuation coverage. That’s a risk you just don’t want to take, whether you’re skiing in the Alps or exploring a remote village in Southeast Asia.

A standalone travel insurance policy is designed to be your primary shield. It offers high-limit medical care, robust cancellation benefits, and critical evacuation coverage that credit cards simply can’t match.

What Is Cancel For Any Reason Coverage?

Let’s demystify the ultimate flexibility tool: ‘Cancel For Any Reason’ (CFAR) coverage. This is an optional upgrade you can add to your policy, and it does exactly what the name implies. It lets you cancel your trip for literally any reason that isn’t covered by a standard plan.

Maybe your best friend suddenly moved their wedding to the same weekend as your trip. Perhaps a huge project at work blew up and you just can’t get away. Or maybe, you just don’t feel like going anymore. A standard policy won’t touch those scenarios, but CFAR will.

Here’s the deal with CFAR:

- It usually reimburses 50% to 75% of your prepaid, non-refundable trip costs.

- You must buy it within that 14-21 day window after your first trip payment.

- You typically need to cancel your trip at least 48 hours before you’re scheduled to leave.

CFAR is a game-changer for those big, expensive, or complex trips where you want total peace of mind. It’s the perfect backstop for that once-in-a-lifetime safari or a multi-family ski trip with a lot of moving parts.

How Do I File a Claim if Something Goes Wrong?

Even with the best plans, sometimes things just happen. The thought of filing a claim can feel overwhelming, but it doesn’t have to be. The key is to act quickly and stay organized.

If you find yourself needing to file a claim, here’s a simple game plan:

- Notify the Provider Immediately: The moment something happens, call your insurance provider’s 24/7 assistance line. They are there to guide you on what to do next and what paperwork you’ll need.

- Gather All Your Documents: This is the most important part. Keep everything—and I mean everything. This includes receipts for extra expenses, doctor’s notes, medical reports, police reports for stolen items, and all communications from airlines about delays or cancellations.

- Keep Detailed Records: Jot down notes about what happened, when it happened, and who you talked to. A clear timeline makes filling out the forms so much easier.

For our clients at Those Who Wander, this is where we really shine. You’re never on your own. We provide hands-on support, helping you navigate the paperwork and communicate with the provider to ensure a smooth, timely resolution. We handle the logistics so you can focus on what’s important.

At Those Who Wander, we build protection and peace of mind into every itinerary we design. If you’re ready to turn your travel dreams into a flawlessly planned and protected reality, let’s start the conversation. Explore how we craft unforgettable journeys at https://thosewhowander.online.

Pingback: Find Your Perfect Voyage--Wanderer's Journal Blog

Pingback: Those Who Wander, LLC

Pingback: How to Plan International Travel-Wanderer's Journal Blog

Pingback: Those Who Wander, LLC

Pingback: Those Who Wander, LLC

Pingback: Those Who Wander, LLC