Best travel insurance for families: Compare plans & save on your trip

The best travel insurance for your family is a comprehensive plan that nails the big three: high limits for emergency medical coverage, trip cancellation, and baggage protection. Even better, many policies offer free coverage for children under 18. While big names like Allianz, AIG, and AXA are always in the mix, the perfect choice really comes down to your family’s unique travel style and where you’re headed.

Protecting Your Family Adventure Before It Begins

Planning a family trip is pure magic. You spend weeks, maybe months, dreaming up the perfect getaway—picturing yourselves swapping stories over gelato in a sun-drenched Italian piazza, spotting toucans in the Costa Rican rainforest, or finally conquering that epic mountain hike you’ve been talking about for years. You book the flights, map out an itinerary, and can almost hear the “Are we there yet?” chants turning into gasps of pure wonder.

But life, especially with kids, is wonderfully unpredictable.

A last-minute ear infection, a lost passport in a chaotic airport, or a freak storm that grounds every flight can bring all that excitement to a screeching halt. This is exactly when travel insurance transforms from a line item in your budget into your trip’s most valuable player.

Why Peace of Mind Is the Ultimate Souvenir

Try to think of family travel insurance not as an expense driven by “what-ifs,” but as a direct investment in your peace of mind. It’s what gives you the confidence to book that ambitious multi-city tour or a jungle adventure, knowing you have a solid safety net if things go sideways. It’s your permission slip to just be present, focusing on building sandcastles instead of worrying about potential disasters.

The right policy isn’t just about covering costs; it’s about preserving the joy of the journey. It ensures your family’s story is about the incredible adventure, not the unforeseen detour that sent you home early.

We built this guide to be your practical map for navigating the world of family travel insurance. We’ll cut through the jargon, compare your options, and help you lock in the perfect coverage so you can focus on what really matters—making unforgettable memories with your favorite people.

Coordinating a big trip is a heavy lift, but protecting it shouldn’t add to the stress. For more tips on getting your crew organized, check out our guide on how to book group travel without losing your mind.

Let’s dive in and make sure your family is covered for the journey ahead.

Decoding What Family Travel Insurance Actually Covers

Picking the right travel insurance for your family isn’t so different from packing your suitcases. You wouldn’t pack snow gear for a beach trip, right? It’s all about building a protective layer that’s custom-fit for your specific adventure, not just grabbing a one-size-fits-all policy off the shelf. Let’s cut through the jargon so you can feel confident you’re getting the right shield for your crew.

At the heart of any solid family travel insurance plan are a few core pillars. These are the absolute non-negotiables that can mean the difference between a minor snag in your plans and a complete vacation disaster.

The Big Two: Medical and Evacuation Coverage

Let’s play out a scenario. You’re two weeks into a fantastic tour of Southeast Asia. Your youngest suddenly spikes a high fever while you’re exploring a remote Thai village, miles from the nearest big hospital. This is exactly when Emergency Medical Coverage steps in to be the hero. Its entire job is to cover the costs of doctor visits, hospital stays, and medicine when you’re abroad—because your health plan back home probably offers zero coverage once you leave the country.

Just as important is Medical Evacuation. If that village clinic isn’t equipped to handle a serious illness, this is the coverage that pays to get your child transported to a proper medical facility. We’re talking about costs that can easily soar into the tens of thousands of dollars.

One crucial detail to watch for is whether a policy offers primary coverage. This is a big deal. It means the travel insurance company pays the bills first, saving you from having to pay a fortune out-of-pocket and then battling your home insurance for reimbursement later.

Trip Cancellation and Interruption: Your Financial Safety Net

Now, picture this. It’s one week before your family’s long-awaited Disney cruise, and your partner takes a tumble and breaks their leg. Ouch. With Trip Cancellation coverage, you can get back the money you’ve already spent on non-refundable things like your flights, the cruise itself, and any pre-paid park passes, as long as the reason is covered by the policy.

Trip Interruption is its on-the-go counterpart. If a family emergency forces you to cut your trip short, this benefit pays you back for the parts of the vacation you didn’t get to use. It also helps cover the insane cost of booking a last-minute flight home. Think of it as the ultimate financial backstop when life throws you a curveball.

Who’s Actually Covered? Defining Dependents

When you see a policy that says it covers “dependents,” what does that really mean? Getting this detail right is key to finding the best policy for your family.

- Young Children: Nearly all family plans will include kids under 18 for free when they’re traveling with a parent or guardian who is insured./spa

- College-Age Kids: Some of the more generous plans will extend that dependent coverage up to age 24 or 25, but usually only if they are still a full-time student.

- Grandparents: If you’re planning a big multi-generational trip, Grandma and Grandpa will almost always need to get their own separate policy. You can’t just add them as dependents onto their adult children’s plan.

The family travel market is a big deal, making up 32.2% of revenue in 2024. Insurers are responding with plans designed for families, sometimes even including specific perks like coverage for quarantine expenses. The whole travel insurance industry is expected to balloon from $25.98 billion in 2025 to $50.77 billion by 2030, which tells you just how many travelers see this as essential protection. For a deeper dive into these market trends, you can check out the analysis over at Mordor Intelligence.

Getting a handle on these basics is your first big step. Now, you’re not just buying a policy—you’re strategically designing a protective bubble around your family’s most precious memories.

Comparing Policy Types for Different Family Vacations

Figuring out the best travel insurance for your family isn’t about finding some magical, one-size-fits-all policy. It’s about matching the right kind of coverage to your family’s unique rhythm and itinerary. A laid-back week building sandcastles in Florida calls for a completely different safety net than a whirlwind, multi-country European tour.

Let’s break down the main players in the insurance game and figure out which one is the perfect sidekick for your next adventure.

Think of it this way: your family’s travel style dictates the kind of protection you need. Are you a one-big-trip-a-year kind of crew, or do you collect passport stamps like it’s a competitive sport? The answer to that question is your first clue.

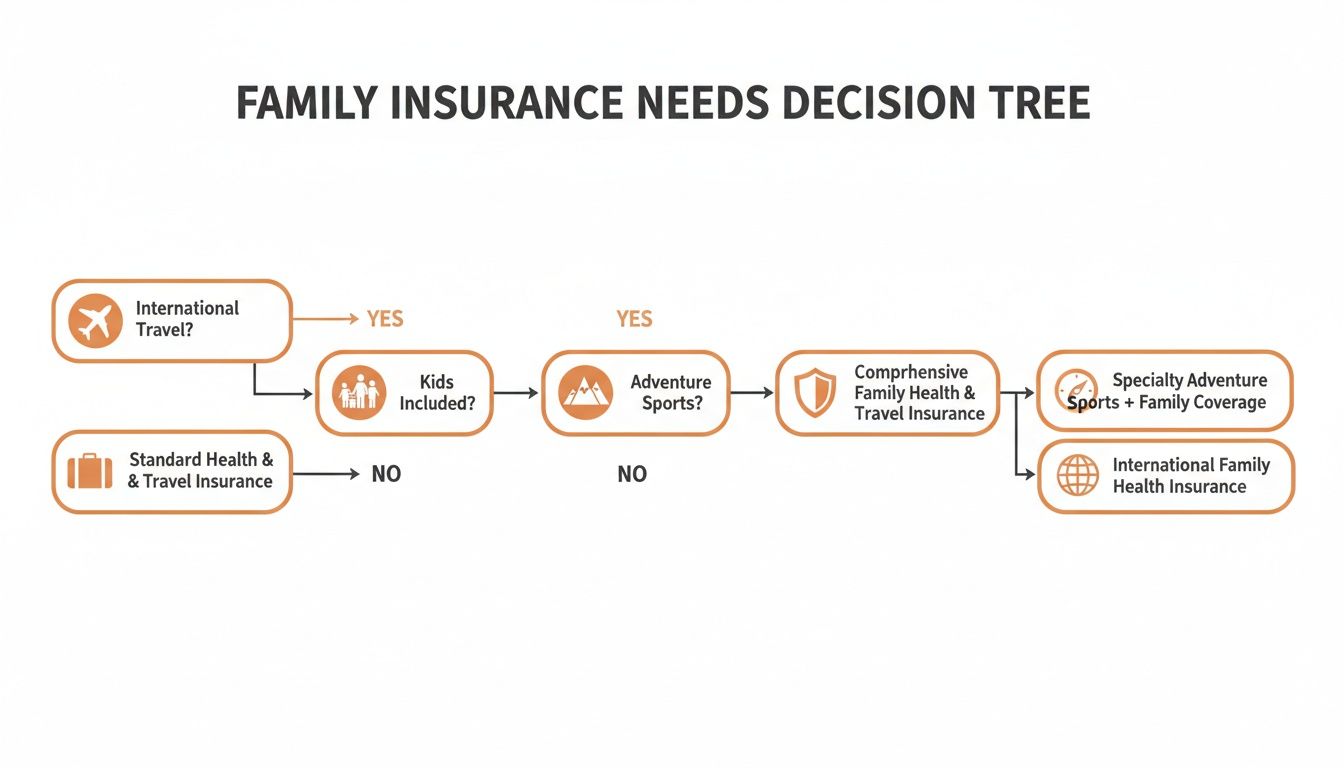

This decision tree helps visualize the key questions you should be asking when picking a plan for your family.

As you can see, where you’re going, who you’re with, and what you’re doing are the fundamental building blocks for getting the right coverage.

Single-Trip Plans: Your Vacation MVP

Picture your family’s dream trip: a two-week safari in Kenya, complete with savanna sunrises and wildlife spotting. This is the perfect stage for a Single-Trip Plan. These policies are designed to cover one specific journey, from the day you leave right up until the day you get back.

They are wonderfully straightforward and cost-effective for that one big annual vacation. You pay for exactly what you need, for the exact duration of your trip. It’s the most common choice and provides solid protection for a specific, well-defined itinerary, from medical emergencies to lost luggage.

Annual Plans: The Frequent Flyer’s Best Friend

Now, let’s say your family calendar is a beautiful mosaic of travel. You’ve got a spring break ski trip to Colorado, a quick summer getaway to Mexico, and a holiday visit to grandparents across the country. Buying a separate policy for each trip would be a logistical nightmare, not to mention expensive.

Enter the Annual/Multi-Trip Plan. You pay one premium for a full year of coverage. This is almost always the more economical and convenient choice for families who take two or more trips per year. It saves you a ton of time and money, ensuring you’re always protected, whether it’s a planned vacation or a spontaneous weekend road trip. This is especially helpful if you’re coordinating travel with extended family; our guide on how to plan a group trip has some great tips for that.

Special Add-Ons: Crafting Your Perfect Shield

Sometimes, the standard playbook just isn’t enough. Your family’s adventures might have some extra spice, and your insurance needs to match that energy. That’s where riders and add-ons come into play.

- Adventure Sports Coverage: Are you planning to ski the Swiss Alps or snorkel along the Great Barrier Reef? A standard policy might see these as “high-risk” activities and flat-out exclude them. An adventure sports rider is absolutely essential to ensure you’re covered if a fun activity leads to an unexpected injury.

- ‘Cancel For Any Reason’ (CFAR) Rider: This is the ultimate flexibility upgrade. Standard trip cancellation only covers specific, listed reasons like illness or a death in the family. A CFAR rider lets you cancel for literally any reason—your pet sitter bailed, you just don’t feel like going, anything—and typically reimburses up to 75% of your non-refundable trip costs. It costs more, but the peace of mind can be priceless.

The family travel insurance market is a serious business, projected to become a $9,859.2 million industry by 2033. This growth is fueled by families demanding more specialized options like these, moving beyond basic coverage to find plans that truly fit their travel dreams.

The Takeaway: Start with a Single-Trip plan for your main vacation. If you travel more than twice a year, an Annual Plan is likely your best bet. Then, layer on specialty coverage like an adventure sports rider to perfectly match your itinerary’s unique thrills.

Matching Your Itinerary to the Right Insurance Plan

Choosing the right plan really comes down to what your trip looks like. The table below offers a side-by-side look at different travel insurance plans to help you decide which one best suits your family’s specific travel plans and risk tolerance.

| Plan Type | Ideal Family Itinerary | Key Strengths for Families | Potential Downsides |

|---|---|---|---|

| Single-Trip Plan | The classic one-to-two-week annual vacation, a destination wedding, or a big family reunion. | Cost-effective for single trips. Coverage is specifically timed and tailored to that one journey. | Can be expensive and tedious if you take multiple trips per year. |

| Annual/Multi-Trip Plan | Families who travel frequently—think weekend getaways, school breaks, and holiday travel. | One-and-done purchase for a year of coverage. Very economical for 2+ trips. Spontaneous travel is always covered. | May have limits on individual trip duration (e.g., 30 or 90 days). The upfront cost is higher. |

| Adventure Sports Rider | Trips involving activities like skiing, scuba diving, rock climbing, or even zip-lining. | Fills a critical coverage gap that most standard policies have. Covers injuries from specific “risky” activities. | Adds cost to your premium. You need to verify which specific sports are included. |

| Cancel For Any Reason (CFAR) | High-cost trips, or when travel plans feel uncertain due to work, family, or personal reasons. | The ultimate flexibility. Get a partial refund (up to 75%) for any reason not covered by standard cancellation. | The most expensive add-on. Must be purchased shortly after your initial trip deposit. |

Ultimately, the goal is to buy the right amount of coverage—not too little, not too much. A quick look at your calendar and your itinerary is the best way to start narrowing down your options and making sure your family is protected, no matter where your adventures take you.

Choosing the Right Coverage for Your Itinerary

The best travel insurance for your family isn’t some off-the-shelf product. Think of it more like a custom suit of armor, built specifically for the adventure you’re about to take. A policy that’s perfect for a lazy beach week in Florida could leave you completely exposed on a rugged mountain trek in Patagonia.

To make this crystal clear, let’s step into the travel plans of three different families. We’ll see how matching their itinerary to their insurance coverage was the smartest move they made.

We’re all about making things happen, so let’s get you inspired—and protected—with some real-world stories that bring these concepts to life.

The Millers Grand American Road Trip

First up, meet the Millers! They’ve packed the minivan for a three-week cross-country journey, hitting iconic national parks from Zion to Yellowstone. Since they’re staying within the U.S., their regular health insurance has them covered for any major medical issues.

Their biggest risks are logistical, not medical. What happens if the rental SUV breaks down in the middle of the desert? Or if a sudden wildfire forces a national park to close for a week, making them forfeit non-refundable cabin deposits? This is exactly where a solid domestic plan proves its worth.

- Essential Coverage: For the Millers, the most critical features are Trip Interruption and a Rental Car Collision Damage Waiver.

- The Save: When a sudden rockslide closes the main road into Yosemite, their trip interruption benefit kicks in. It covers the cost of their forfeited lodge deposit and helps pay for a new hotel two hours away, keeping the adventure rolling without a massive financial hit.

The Jacksons Alaskan Family Reunion Cruise

Next, let’s look at the Jackson family. They’re celebrating Grandma and Grandpa’s 50th anniversary with a huge multi-generational cruise to Alaska. With travelers ranging from a toddler with asthma to an 80-year-old grandfather, their risk profile is a whole different ballgame.

An illness onboard or a simple slip on a wet deck could easily overwhelm the ship’s small medical clinic. Worse, a serious medical event in a remote Alaskan port would require an eye-wateringly expensive airlift to a proper hospital in Anchorage or Seattle.

For any international trip—especially one with a wide range of ages—high-limit emergency medical and evacuation coverage is non-negotiable. It’s the single most important protection you can buy.

Their ideal policy has to include:

- High Medical Limits: At least $100,000 per person to handle any serious medical needs that might pop up onboard.

- Emergency Evacuation: A minimum of $500,000 for a helicopter or air ambulance if the unthinkable happens.

- Pre-Existing Condition Waiver: This ensures Grandpa’s heart condition is covered in an emergency, giving everyone peace of mind.

Putting together a big family get-together like this takes work, but the right protection makes it truly worry-free. If you’re looking for ideas on where to host your own epic family adventure, check out some of the best family reunion destinations to get your planning started.

The Chens Swiss Alps Ski Adventure

Finally, let’s join the Chens, a family of thrill-seekers hitting the slopes in Zermatt, Switzerland. Their days will be packed with black diamond runs, snowboarding, and maybe even a little paragliding. Their biggest risk is pretty obvious: a sports-related injury.

A standard travel insurance policy would likely see skiing as a “hazardous activity” and flat-out deny any claim related to a fall on the mountain. Without the right coverage, a broken leg could easily turn into a six-figure bill for a mountainside rescue, a stay in a Swiss hospital, and a business-class flight home.

- The Must-Have: The Chens absolutely need a policy with an Adventure & Sports rider. This add-on specifically extends their medical coverage to injuries sustained while participating in listed high-risk activities.

- The Save: When their teenage son takes a nasty fall and dislocates his shoulder, their adventure sports coverage kicks in immediately. It covers the ski patrol rescue, the emergency room visit, and all the follow-up care, turning a potential financial catastrophe into a manageable inconvenience—and a great story for later.

Our Approach to Your Family’s Safety Net

Feeling a bit overwhelmed by all the insurance options out there? That’s totally normal, and honestly, it’s where we do our best work. At Those Who Wander, we think protecting your family’s big adventure should be just as seamless as planning it. When you work with us, we’re not just booking your trip; we become your dedicated partners in making it all happen, safely and smoothly.

Think of us as your personal insurance navigators. Backed by our industry know-how and our affiliation with Fora Travel, we dive headfirst into the world of complex policies so you don’t have to. The process is pretty straightforward: we start by listening to your family’s unique story.

Your Itinerary is Our Blueprint

Where are you heading? What incredible things are on your family’s must-do list? Are you concerned about a pre-existing condition, or maybe you’re traveling with grandparents and grandkids all together? The details of your itinerary give us the blueprint we need to build your perfect safety net.

We take all these pieces—your destinations, activities, and specific worries—and put together a shortlist of insurance options that are a perfect match for your custom trip. There’s no generic, one-size-fits-all solution here; it’s all about finding the policy that speaks your family’s language.

We’ll handle the fine print, the exclusions, and all the jargon. Your job is to focus on daydreaming about gelato in Rome or spotting a lion on the Serengeti. We’ll take care of the rest, making sure your peace of mind is packed right alongside your passports.

The demand for this kind of protection is growing, and fast. The family travel insurance market is absolutely booming, with families generating an astounding $6,066.3 million in revenue in 2024 alone. Experts project that figure will soar to $13,787.1 million by 2030—a clear sign that families are putting a premium on the security of their travels. You can find more insights on this trend over at Grand View Research.

From Safari Jitters to Ski Trip Security

Let’s get specific. Say you’re planning that dream safari in Tanzania. You’re worried about what might happen if a medical emergency pops up far from a major hospital. We’ll pinpoint a policy with serious medical evacuation limits, ensuring you’re covered for an airlift if it ever comes to that.

Or maybe you’re organizing a multi-family ski trip to the Alps. We’ll find a plan with a top-notch adventure sports rider, making sure a tumble on the slopes doesn’t turn into a mountain of medical bills.

Here’s a look at how we make it happen:

- Deep Dive Consultation: We kick things off with a conversation to really understand every detail of your trip and your family’s needs.

- Custom Curation: We sift through countless policies to find the handful that offer the best possible coverage for your specific itinerary.

- Clear Comparisons: We lay out your options in a simple, easy-to-digest way, explaining the pros of each without drowning you in details.

- Seamless Integration: Once you’ve made your choice, we handle the logistics, weaving the policy right into your overall travel plan.

Our whole mission is to take the guesswork and anxiety out of the equation. We’re here to make sure your family’s travel story is filled with joy and unforgettable moments—all backed by a safety net built just for you.

Got Questions About Family Travel Insurance? We’ve Got Answers.

We’ve covered a lot of ground, from policy details to trip scenarios, but you probably still have a few things you’re wondering about. That’s a good thing—it means you’re taking your family’s safety seriously.

Let’s tackle some of the most common questions we hear from families. Our job is to give you clear, no-nonsense answers so you can make your decision with confidence.

When Should We Buy Travel Insurance for Our Family Trip?

This is a great question, and the answer is surprisingly simple: buy it right after you make your first non-refundable payment. That could be your flights, a deposit on a tour, or locking in that perfect Airbnb.

Getting your policy early isn’t just about checking a box; it’s one of the smartest things you can do. It flips the switch on your coverage immediately, and a lot of the best benefits are time-sensitive.

For instance, if you need coverage for a pre-existing medical condition, most policies require you to purchase within 14-21 days of your initial trip deposit. The same goes for the incredibly useful ‘Cancel For Any Reason’ (CFAR) upgrade. Drag your feet, and you might lose out on these game-changing protections.

Think of it this way: buying your policy right away wraps your entire trip in a protective bubble from the get-go, covering you for any unexpected hiccups in the months leading up to your departure.

Does Travel Insurance Cover COVID-19 Complications?

In this day and age, this is probably the first question on every parent’s mind. The good news is that most travel insurance plans have adapted and now treat COVID-19 just like any other sudden illness.

Generally, this means you’re covered for:

- Trip Cancellation: If you or a family member catches COVID-19 before you leave and a doctor says you can’t travel, your policy should cover your non-refundable trip costs.

- Emergency Medical Care: If you get sick with the virus while you’re away, your medical benefits should kick in to cover treatment, just as they would for a sprained ankle or food poisoning.

- Trip Interruption: If a COVID-19 diagnosis forces you to quarantine or head home early, your benefits can help with the costs of an extended stay or last-minute flights.

Here’s the key distinction, though: canceling a trip because you’re worried about rising case numbers or a new travel advisory isn’t typically covered. For that kind of flexibility, you’d need a ‘Cancel For Any Reason’ (CFAR) rider. We always make sure to find policies with crystal-clear language around COVID-19, so there are no surprises when you need the coverage most.

Are Our Kids Automatically Included in a Family Plan?

Usually, yes! This is one of the best parts about getting a policy designed for families. Many providers will include kids on a parent’s or guardian’s plan for free or at a steep discount. But, as always, the devil is in the details.

You absolutely have to check the policy’s definition of a “dependent.” Most of the time, it covers children under 18 traveling with an insured adult. Some of the better policies will even push that age limit up to 24 if your child is a full-time student.

When you get a quote, you must list every single traveler by name—kids included. This officially adds them to the policy and ensures they have full access to all the benefits. Never assume they’re covered just because you bought a “family” plan.

This is especially handy for those amazing multi-generational trips. The grandparents will need their own policy, but the grandkids can almost always hop on their parents’ plan, making it a super cost-effective way to protect the whole crew.

What About Adventure Activities Like Skiing or Ziplining?

For any family with an adventurous side, this is a big one. You’ve booked a ski trip to Whistler or a jungle adventure in Costa Rica complete with ziplining and rafting. It’s easy to assume your standard travel insurance has your back, but that could be a massive—and expensive—mistake.

Many basic policies have a whole list of exclusions for activities they consider “high-risk.” You might be surprised what’s on there:

- Skiing and snowboarding

- Scuba diving

- Rock climbing

- Horseback riding

- Even things that seem tame, like hot air ballooning

If someone gets hurt doing one of these excluded activities, your claim for medical bills will almost certainly be denied. That could leave you facing thousands of dollars in medical costs, especially if a rescue or evacuation is needed.

The solution is to find a policy that either includes these activities from the start or offers a specific ‘Adventure Sports’ rider you can add on. We make it a priority to cross-reference your family’s itinerary with a policy’s fine print. That way, your adventurous spirit is fully protected, and you can chase those thrills without worrying about the “what ifs.” After all, the best stories usually come from pushing the boundaries just a little.

Figuring out travel insurance can feel like a heavy lift, but you don’t have to go it alone. At Those Who Wander, LLC, our specialty is taking the guesswork out of protecting your journey. We’ll listen to your plans, understand what your family needs, and find the perfect policy to match your unique adventure. Let us handle the details so you can focus on what really matters—making memories.

/spa

Ready to build your family’s safety net? Let’s start planning your protected adventure today.

Pingback: Your Ultimate Guide to Hawaii Big Island Scuba Diving

Pingback: A Guide to Travel Insurance Options-Wanderer's Journal Blog

I would like to express my appreciation to the writer for bailing me out of this matter. Just after checking through the the net and seeing strategies which are not helpful, I believed my life was over. Existing devoid of the strategies to the problems you’ve resolved by means of your main website is a critical case, as well as those that would have adversely affected my career if I had not noticed your web blog. The mastery and kindness in playing with the whole lot was very helpful. I’m not sure what I would have done if I hadn’t come across such a solution like this. I’m able to at this point relish my future. Thanks so much for the professional and effective help. I won’t be reluctant to endorse your site to anyone who needs and wants guidelines about this subject.